Owning your own home is a quintessential part of the American Dream. But as home prices rise, you might ask yourself—is homeownership really worth it? Below are five benefits of homeownership that may help you decide to take the leap.

1. Homeownership is a great long-term investment

Buying a home is one of the best long-term investments you can make. For the most part, housing prices are steady, so your property’s value probably won’t increase dramatically in the short-term. However, in the long run, it’s highly likely that you’ll be able to sell your home at a profit. This is especially true in the Pacific Northwest, where demand for property is pushing up against limited inventory. Cities in Washington and Oregon continue to grow as folks relocate from more expensive locales. As more occupations allow telecommuting, analysts believe that the demand for housing will only continue to grow.

Nationally, residential real estate trends are steadily rising as well, meaning that most homes will continue to appreciate in value. Median housing prices in the United States rose from $298,900 at the end of 2014 to $346,800 at the end of 2020. That’s a 16% increase in value over just six years. A high return on investment (ROI) that also provides you with a place to live is a huge benefit of owning your own home.

2. A chance to build equity

Your home will likely appreciate in value over time. It’s important to know, however, that appreciation and equity are two different things. What exactly is equity? Equity is the difference between what you still owe on your mortgage and your home’s market price. Equity and appreciation should work in tandem to increase the benefits of your investment over time.

Think about it this way—while your home appreciates due to an increase in real estate values, you’re also making payments on your mortgage. This means that you’re closing the distance between the balance on your home loan and outright ownership. An increase in your home’s value can also help close that gap. The upshot? The longer you stay in your home and make regular payments on your mortgage, the more equity you can build. Appreciation and equity can act as an extremely high-return, long-term savings account.

3. Accessing equity

Once you’ve built equity in your home, you have more options for paying for things like investment rental properties, college tuition or home improvements. Home equity lines of credit and cash-out refinances allow you to tap into the wealth that is tied to your home. That way, you won’t have to wait to sell your home to realize some return on your investment.

HELOC

Homeowners sometimes use home equity lines of credit, or HELOCs, to earn more money through other properties or to pay down high-interest debt. Alternatively, you could use those funds to make any needed improvements or repairs to your home. This will help to counter any depreciation of the property (for example, fixing an aging roof, replacing drafty windows or upgrading your HVAC system). The choice is yours.

Life is full of unexpected expenses, and having equity in your home allows you more flexibility in budgeting for those surprises. A HELOC works like a credit card, but uses your home as collateral. It can be an extremely useful source of funds because HELOCs often have lower interest rates than you would find with a commercial loan.

They also come with something called a “draw period,” which usually lasts 5 to 15 years. During this time, you’re typically required to make interest-only payments on the outstanding balance, and a huge benefit is you only borrow the money you really need. The ability to withdraw funds through a flexible, low-interest financial product tied to your home equity is another substantial benefit of homeownership.

Cash-out refinance

You can also utilize your home’s equity through a cash-out refinance. With this option, you refinance your mortgage and borrow more than you owe. The surplus is then distributed to you, the homeowner. This money can be used just as you’d use a HELOC. The difference is that the full amount is provided as one large lump sum rather than as needed.

4. Budgeting and tax benefits

Tax deductions and savings are a lesser-known benefit to homeownership. For instance, if you decide to take out a cash-out refinance or HELOC to improve your home, the interest you pay on that loan can betax-deductible. You can also deduct $10,000 in state and local taxes, including property taxes. You can even save thousands of dollars each year by deducting the mortgage interest on your home (up to $750,000 of your total mortgage debt, including HELOCs). Tax deductions lower the amount of your taxable income at the end of the year.

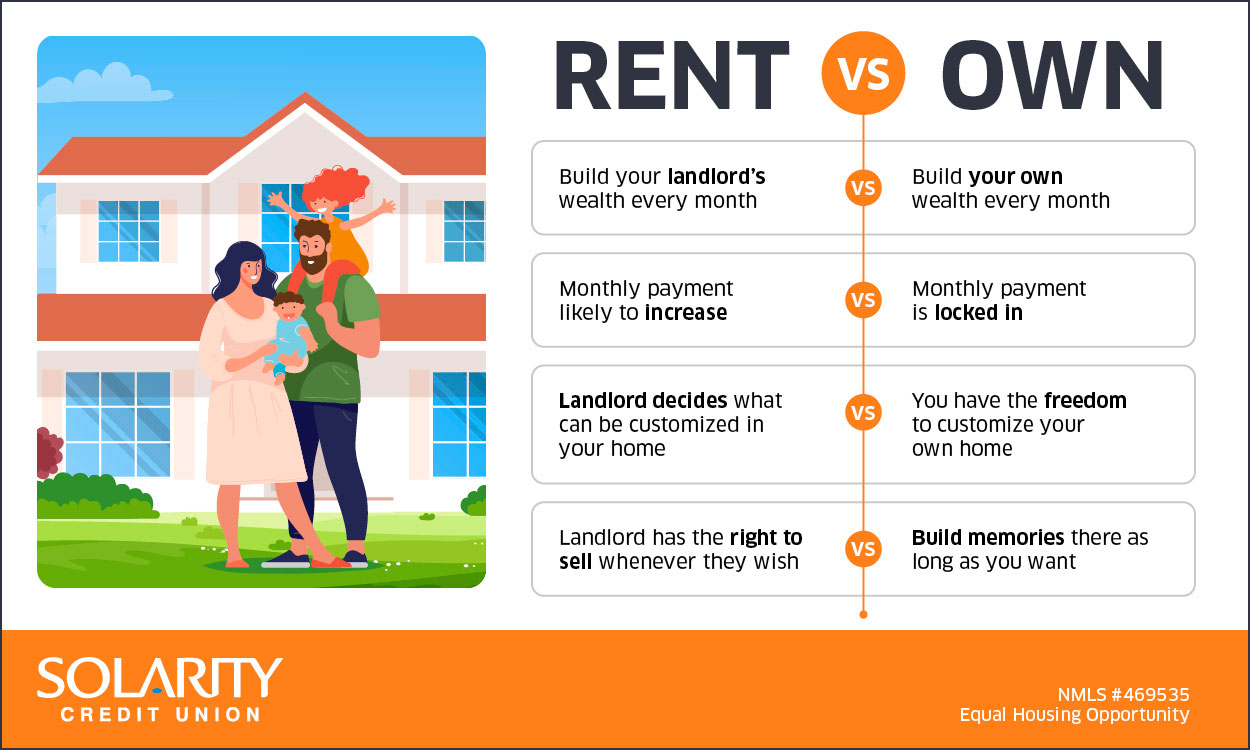

Aside from the ability to write off some of the debt that you may accrue through purchasing a home, you’re also locking in a monthly housing cost when you take on a mortgage. While renters aren’t responsible for home improvements, they are at the mercy of their landlords and the market, which may make intermittent rent increases a constant.

Homeownership gives you more control over your finances in general. You’ll be certain of the monthly payment you’re responsible for while living in the house. You’ll also have the benefits of federal and state incentives for homeowners. Lastly, you’ll have the opportunity to build a strong credit history by making your mortgage payments on time.

5. Pride and privacy

There are social benefits to homeownership—it’s a dream for many and for a good reason. Renters frequently live with numerous restrictions, from the color of the paint in their homes to whether they can adopt a pet. Homeownership provides a lot of responsibility but also a lot of freedom. You can customize and improve your home any way you wish. The more equity you build in your home, the easier that becomes as cash-out refinancing and HELOCs become an option.

Homeownership can build generational wealth if you decide to pass your home on to your children. In essence, homeownership gives you more control over your finances, your living space and your future.

As you can see, there are many benefits to homeownership. It may also be easier than you think to secure a mortgage. Talk with a Home Loan Guide at Solarity Credit Union to find out if homeownership is right for you.What's your Solarity story?

We're on a mission to tell the stories of our members and how they are living their best lives. Do you have a Solarity story to share?