Articles

March is fraud prevention month. At Solarity, we are always trying to help keep you (and your money) safe. That’s why we continually shed light on ways that bad actors are trying to scam you and take your money. However, sometimes it’s helpful to take proactive steps to prevent you from being a target in the first place. Here are a few ways to help you avoid falling victim to scams or fraud.

Use your card for online purchases

Using your debit card online is a great way to make purchases easily. However, you want to make sure you’re doing so safely. Check your bank statements often. Also, be sure to keep your PIN safe. Only check out on websites you know are secure. Finally, avoid using public Wi-Fi connections to complete purchases.

Keep track of your purchases

Set up alerts to make sure no unauthorized transactions are going through on our accounts. You can do this in mobile/online banking and through Visa. Set up alerts for certain transaction types, like transactions over $500, or you can choose to set them up for all transactions. This helps you know right away if fraud is occurring on your account.

Keep your PIN safe

Don’t store your PIN in your wallet or purse. Your PIN should be something you remember easily but that bad actors could not guess or find out about you – avoid birthdays, zip codes, etc. You can also use your debit card in credit card mode, so you don’t have to enter your PIN. Don’t give your PIN to anyone, whether you trust them or not.

How to recognize a secure website

Look at the URL – a secure URL should begin with “https” rather than “http”.

In certain browsers, look for a lock icon near your browser’s location field. The lock symbol indicates the connection between your web browser and the website server is encrypted, which means it’s safer than most.

Lots of ads try to impersonate authentic, secure websites. If you have doubts about an ad or a URL, type what you’re looking for into a search engine. The official site is typically near the top of the search results. Google also helps you by ranking the better search results higher than the deceptive ones. For example, tiffanycoshop.com is NOT the official website of Tiffany & Co. The correct website is Tiffany.com. Stay vigilant and check the URL before you click to make sure the search results aren’t tricky scammers mimicking the real site.

Safety best practices

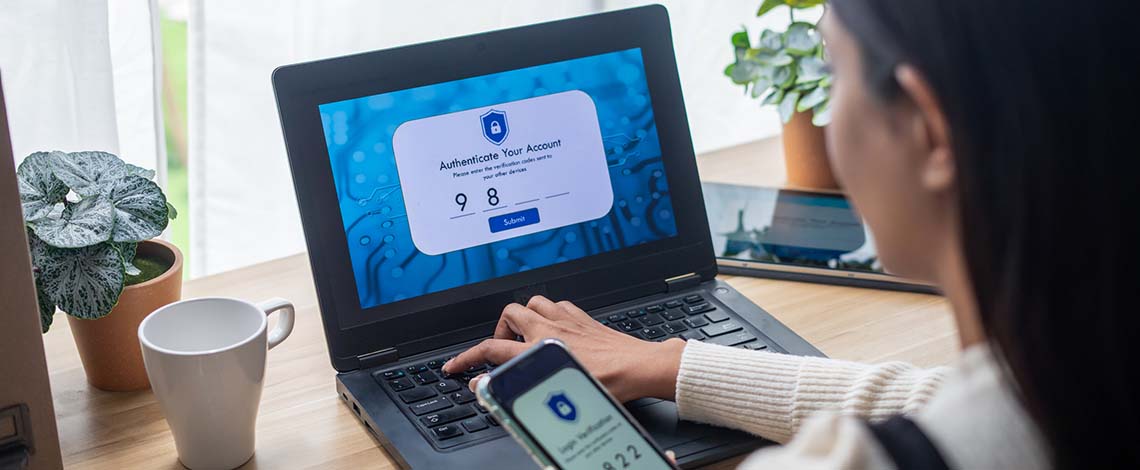

Enable multi-factor authentication in your banking app. This allows you to put another layer of protection on an app that stores sensitive information. Think fingerprint, face ID, a one-time PIN or a security question!

Add your card to your mobile wallet. Contrary to popular belief, one of the most secure ways to use your card is by adding it to your mobile wallet. Check out all the benefits here: All the benefits of setting up your mobile wallet

Use strong passwords and change them regularly. This is one of the easiest ways to protect yourself online. Don’t reuse passwords for different accounts. And don’t forget to change your password occasionally – experts recommend every three months and immediately in case of a breach.

Never use “open” public Wi-Fi for transactions. Unsecured Wi-Fi can be a source for fraudsters to gain access to your information. If you’re making an online purchase or transaction, make sure you are on a secure, password-protected Wi-Fi network or are not using Wi-Fi at all.

Monitor your account for unauthorized transactions or odd behavior. Enroll in mobile banking and log in every few days to make sure all transactions are legit.

Choose trustworthy financial apps. For example, some budgeting apps may ask you for your online banking login credentials to pull data together, which puts you at risk. Don’t use apps that aren’t thoroughly tested. Read the reviews, ask friends and family, and do your research before giving an app any of your data.

Always be on the lookout for scams. Fraudsters are always coming up with new ways to trick people. Be on alert no matter what.

Keep your software up to date, both on your computer and your phone. This is a simple way to keep your data secure. Phone manufacturers have security patches they push through regularly, so make it a priority to update when a new patch comes along.

Never give out personal information in response to a request you didn’t expect. When in doubt, hang up and call a number you trust (like the number on the back of your debit or credit card). Scammers often try to use pressure or a hurry-up method to get you to act fast and without thinking. Remember, most trustworthy organizations you do business with will never ask for your login information or pressure you to send them money.

Shred sensitive documents when they are no longer needed. If you don’t have a shredder, you can take them to an Office Depot or another local shredding company.

If you receive communication claiming to be from Solarity and it doesn’t feel right, please reach out. We’re happy to help you decipher if something is legit or not. And remember – Solarity will NEVER send messages asking for sensitive account information. When in doubt, reach out to us here at Solarity!

Related articles

Beware of scammers impersonating Solarity, other financial institutions; red flags to watch for

Scammers never take a day off and can be quite crafty. They will often impersonate people you trust, including your financial institution.

Protecting your money: How to recognize a scam

Fraudsters and identity thieves are constantly on the hunt for your money but there are some tell-tale signs that should become immediate red flags every time. Watching f...

How to guard against account takeover fraud

Join us as we discuss the growing threat known as account takeover fraud and pick up a few tips to help prevent it from happening to you.