Both a home equity line of credit (HELOC) and cash-out refinance let you tap into the equity in your home, and depending on what you need the money for, one option could be better for your unique needs. While similar, there are a couple of differences. If you prefer the ability to make periodic withdrawals, you might lean towards a HELOC. If you want to lock in your rate and make one payment each month instead of two, a cash-out refinance may be a better option for you.

A HELOC allows you to borrow the money when you need it, almost like a credit card. The line of credit is there for the taking, and you draw on it as needed. Many people use the equity in their home to help cover college tuition or large, unplanned expenses. Because HELOC rates are often significantly lower than credit cards, these funds can be a great option for paying off higher interest debt (also known as debt consolidation). A HELOC is also a useful way to add even more value to your home through repairs or a remodel. And while you should always consult with your tax professional, the interest on HELOC dollars used toward home improvements may be tax deductible. At Solarity, you can make interest-only payments for the first five years!

A cash-out refinance, on the other hand, replaces your current mortgage with a new mortgage, rate and term. You “cash out” a portion of the equity in your home and receive a one-time, lump-sum that lands in your bank account to spend as you wish. Before you close, you decide the amount of money you want to receive as cash, and your rate, loan amount and payment are based on how much you pull out.

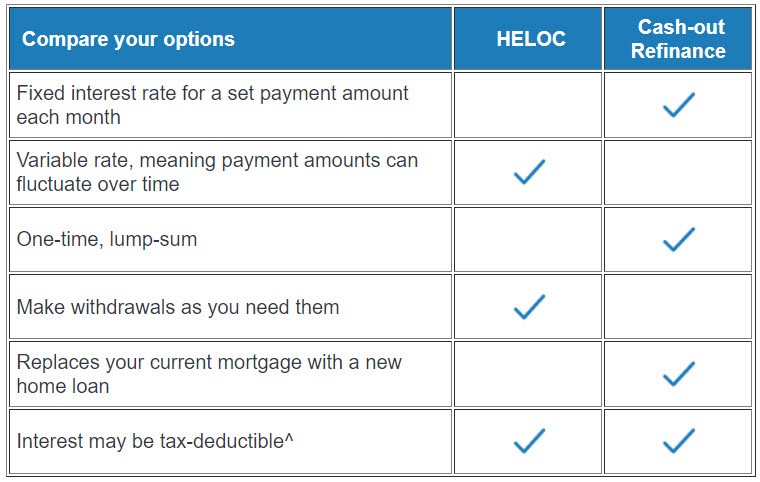

Below is a handy chart that outlines key differences between the two options:

The good news? You’re not alone in this decision. Solarity’s expert Home Loan Guides can help you crunch the numbers and determine which choice is the right fit for your budget and needs, with no obligation to apply. We will help you discover what’s best for your unique circumstances. We’re here when you need us!

^ Consult a tax professional for advice about your specific situation.

What's your Solarity story?

We're on a mission to tell the stories of our members and how they are living their best lives. Do you have a Solarity story to share?