Get the home field advantage

Introducing Solarity's new Bonus Savings account – your ticket to exceptional savings! Earn an impressive 2.01% APY* on your entire balance with no service fee and no limits on how much you can earn.

To qualify for the highest rate, sign up for eStatements, link Bonus Savings to a Solarity checking account and make 20 or more debit card purchases each month. It's easier than getting that mustard stain out of your favorite jersey.

Ready to get in the game and start saving more? Give us a call at 800.347.9222, visit one of our branches or open an account online to get started.

Bonus Savings: Earn 40x more than Solarity Primary savings

Score big savings

Open your account

Open a Bonus Savings account and link it to your Solarity checking account.

Use your debit card

Enroll in eStatements and make 20+ debit card purchases a month.

Earn the best rate

You'll earn 2.01% APY on your entire balance with no service fee and no limits on how much you can earn.*

A better way to bank

At Solarity, we've been helping families, businesses and the community since 1939.

Solarity Credit Union has the same products and services you'll find at the big banks plus one very important thing they lack: employees who genuinely care about you as a person rather than a number.

Founded on the principle of people helping people, Solarity offers all the convenience you'd expect: multiple account options, free online and mobile banking, competitive rates and more. Open an account today to take advantage of everything membership has to offer.

Introducing Bonus Savings – your path to earning more than a regular savings account.

Our members say it best

Frequently asked questions

Solarity membership is open to everyone! You qualify to join Solarity if one of the following applies:

- You live, work, worship or attend school in the state of Washington -or-

- You have a family member who is already a Solarity member -or-

- You are a member of the GoWest Foundation (you can easily join by becoming a “Friend of the Foundation” for a nominal donation)

If you would like to learn more about becoming a Solarity member, get in touch with us! We’ll explain all the options and help you get started.

Opening an account is easy! You can do it online in less than five minutes.

If you’re new to Solarity and wish to become a member, start here. If you’re already a member and would like to open additional accounts, start here.

You will need:

- Government issued ID/Drivers License/State ID or Passport

- Your complete physical and mailing address

- Social Security number

- Date of birth

Please allow one business day for us to process your account application. If you have any questions, please feel free to call us at 800.347.9222.

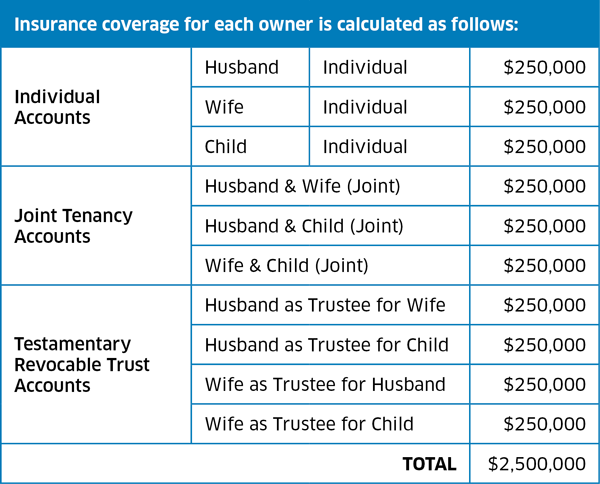

Credit union deposits are federally insured, but not by the FDIC. Instead, they are insured by a separate government agency called the National Credit Union Administration (NCUA). The NCUA insures deposits at credit unions, while the FDIC insures deposits at banks. Both the NCUA and FDIC offer the same amount of insurance for depositors.

Credit union deposits are insured by the NCUA for up to $250,000 per depositor for each account type, which is similar to the FDIC, which insures deposits held at banks for the same amount. That said, there are ways to structure your credit union accounts to increase your NCUA insurance coverage above this amount. You can do this by opening multiple accounts with different types of ownership, such as a single, joint, trust, corporation/partnership and self-directed retirement account (IRA).

Each account type is insured separately, so having multiple accounts with different ownership types can increase the amount of coverage. For example, this chart created by the NCUA shows how a family of three could be insured for up to $2,500,000.

To make the switch from paper to electronic statements, follow these four steps.

- Log into online banking

- Locate Settings then click Additional Services

- Select eStatements

- Then choose to change your accounts to eStatements to avoid the $4 per month paper statement fee.

Please note: If you don’t have access to online banking, you will need to enroll in online banking before you sign up for eStatements.

If your debit card was declined, please reach out to us via live chat or by calling 800.347.9222. We'll be happy to assist.

Ready to open an account?

We make opening your account FAST and EASY! See below for the ways you can get started.

Online (members)

Already a Solarity Credit Union member? Click below to open your account today!

Let's do itOnline (new members)

This offer isn't just for current members! It only takes a few minutes to fill out an application.

Get startedBy phone

Give us a call at 800.347.9222. We'll explain your options and help open your new account.

Call nowAt a branch

Stop by any of our local branches and speak with one of our helpful experts.

See locationsMore ways to save

Money market savings

For savvy savers! The more you save, the more you earn with tiered rates and no monthly service fee.

Let's go

Certificate accounts

A stable, secure way to grow your money, especially funds you don't need access to right away.

Find out more

Dividend checking

Convenient, drama-free access to your money while also earning dividends with higher rates for higher balances.

"Check" it out